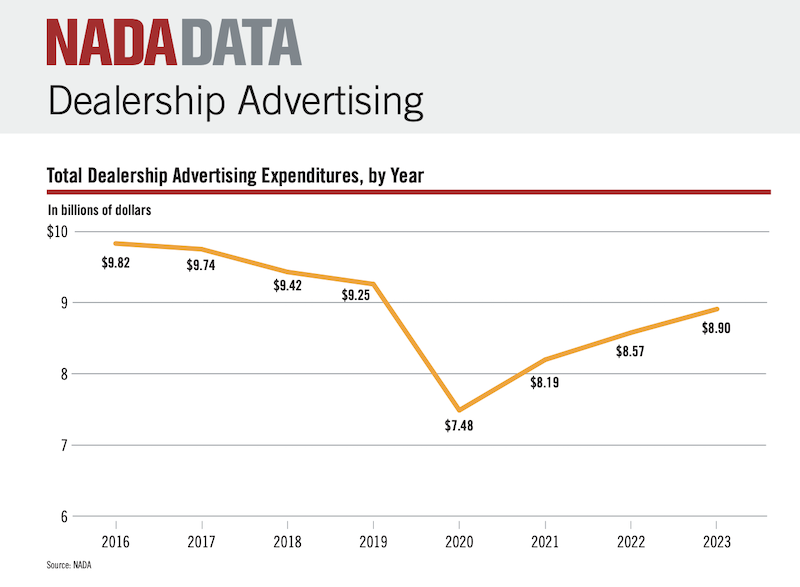

In 2023, the auto industry’s advertising efforts saw a notable resurgence from the pandemic, according to the National Association of Automotive Dealers (NADA). NADA’s 2023 Full Year Report highlighted that the nation’s 16,835 franchised dealers collectively spent $8.9 billion on advertising—an increase of 4 percent from the previous year, and a significant rebound of $330 million from 2022 and $1.4 billion from the 2020 low.

Despite this growth, the total spent on advertising still trails behind the pre-pandemic levels, reflecting the critical need for effective local advertising strategies that can help dealers squeeze more ROI out of every ad dollar spent. NADA data reveals that dealership advertising peaked in 2016 at $9.82 billion.

Breaking down these expenditures, NADA’s report shows that 15.5 million light-duty vehicles were sold, contributing to sales surpassing $1.2 trillion. The average new car sold for $47,014, while dealers moved 12.7 million used cars at an average price of $29,308. Importantly, the average dealership spent $708 on advertising per new car sold last year, a slight decrease from $718 the previous year but still higher than the $640 spent in 2019 and $582 in 2020.

When layering on increasing sales pressure from competing dealers, it becomes clear to see the critical importance of producing high-quality ads that attract consumers who are ready to buy. Studies show that dealers who consistently run better ads yield more ROI from their media spend.

The data underscores a critical trend: while overall advertising spend is on the rise, the quality and strategic direction of these ads, particularly in digital and streaming formats, are essential for dealerships to reclaim and exceed their pre-pandemic marketing effectiveness. Local dealerships must continue to innovate and improve the quality of their advertising to stay competitive in an evolving market.

Download the full NADA report here. And use the form below to let me know if you have any questions!