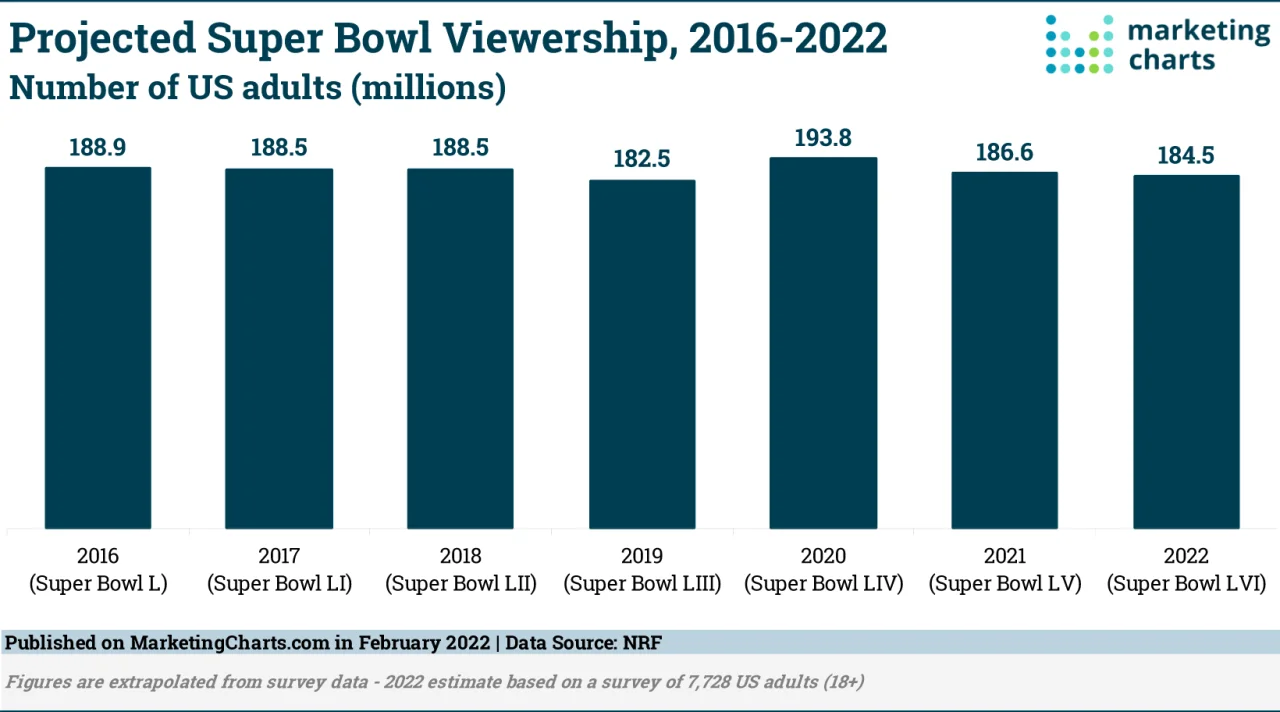

After 21 weeks of play (18 weeks of the regular season and 3 weeks of playoff games), the Super Bowl 56 contenders have been decided, with the Los Angeles Rams and Cincinnati Bengals meeting at the SoFi Stadium in Inglewood, CA. And, while the stadium is expected to be full this year, fewer fans plan to tune in to the game this year than last. A survey of more than 7,700 US adults conducted by the National Retail Federation (NRF) indicates that 184.5 million adults plan to watch. That’s about 2 million fewer viewers than last year’s projected viewership of 186.6 million.

While fewer adults plan to view the game, retail spending surrounding the event is expected to increase from $13.9 billion in 2021 to $14.6 billion this year. The average spending per person is estimated to be $78.92, which is still below the average spend seen pre-pandemic, but more than last year’s $74.55. Following a well-established trend, the most popular spending area, for 79% of viewers, will be food and beverage, with team apparel and accessories being a distant second, at 11%.

It’s worth noting that results from a Morning Consult survey come to a different conclusion: in fact, the study suggests that adult viewership will be at its highest since 2019, with two-thirds of adults planning to tune in. The increase in planned viewership from last year (61%) is attributed to an increase in younger viewers, with more Gen Z and Millennial adults planning to watch the game.

Meanwhile, only a slight majority (55%) of Super Bowl viewers are most interested in the game itself, per an NCSolutions survey of roughly 2,000 respondents, with about one-quarter (26%) most interested in the halftime show and about one-fifth (19%) in the ads.

Super Bowl Ad Stats

Super Bowl ad prices are expected to rise for Super Bowl 56, with the average expected price for a 30-second spot reaching $6.5 million, per the latest research published by Kantar. This is up from the record $5.5 million per 30-second ad seen last year for Super Bowl 55.

Looking back to last year’s Super Bowl, in-game ad revenue brought in a total of $434.5 million, which is less than the $448.7 million in ad revenue from Super Bowl 54.

Here are some other stats from Kantar’s latest annual analysis:

- Although ad spend for the Automotive category was $20 million less than it was in 2020, this category remained the top advertising category for 2021. Automotive was followed by the Beer & Wine and Financial categories. Kantar also notes that the Restaurants category saw spending of $33 million, which is the first time the category had double-digit spending in the millions.

- Anheuser-Busch InBev remained at the top of the Super Bowl spenders list in 2021. This is despite the company spending $10 million less than what it spent in 2020.

- After testing more than 90 Super Bowl ads from 2021, Kantar’s analysis shows that “Strong” (based on creative effectiveness) Super Bowl ads saw three times the ROI and 40% higher ad recall than “Average” Super Bowl ads.

-

More Pre-Game Data

- The pandemic put a damper on consumers attending or holding Super Bowl parties last year. In 2021, fewer than half of consumers who typically attend or host a Super Bowl party surveyed by Morning Consult said they were very (26%) or somewhat (20%) likely to attend or host a Super Bowl party. In what looks like a return to normal, this year, about 7 in 10 consumers who typically attend or host a Super Bowl party are very (40%) or somewhat (31%) likely to do so this year.

- With streaming becoming the preferred way of watching TV, data from Adtaxi indicates that digital will account for almost half (49%) of the total Super Bowl audience this year. They won’t all just be watching the game either. Some 46% of Americans will be interacting with other media while watching the game, including 3 in 10 (31%) using social media, 15% visiting sports websites and 8% using online forums.

- Speaking of social media, data from Hootsuite and The Drum shows that top Super Bowl advertisers Avocados From Mexico and Pepsi were two of the most talked about brands on social media. PepsiCo garnered 20,700 mentions on social media between September 2021 and the end of January 2022, with 4 in 10 (39% of) those mentions indicating positive feelings and only 1% indicating negative feelings. Avocados From Mexico had 10,600 mentions on social media during the same time period. Of those mentions, 64% were positive, with the remaining mentions indicating neutral sentiment.

source: marketingcharts.com

If you’d like to learn more about how Bob Abbate Marketing can help you boldly build your small business brand, just reach out to us by filling out this form. We’d love to chat!